Table of Contents

Introduction: The Challenge of Tracking Tech Giants – Beyond the Headlines

Conducting a thorough AI analysis of MAG7 companies – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, Tesla, plus the influential Broadcom (AVGO) – presents a monumental data challenge. Yet, understanding their strategic trajectories from primary sources like SEC filings is crucial. This post details how AiAtHand performed an in-depth AI analysis of MAG7 (+AVGO) SEC filings over the past 5-6 years, moving beyond simple keyword searches to uncover evolving trends in strategy, AI investment, risk, and ESG. We’ll share key insights, including surprising developments in Apple’s AI journey and Google’s strategic hardware advantages, and offer a sample of our structured data output.

The Mission: Deep Dive AI Analysis of MAG7 (+AVGO) Strategic Narratives

For this demonstrative AI analysis of MAG7+AVGO SEC fillings, our objective was to move beyond simple keyword searches and ask nuanced questions on a per-document basis, then synthesize these into observable trends.

- The “Input” for AiAtHand:

- Companies: Apple (AAPL), Amazon (AMZN), Broadcom (AVGO), Alphabet (GOOGL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), Tesla (TSLA).

- Period: Primarily 2019-2024 (with some 2018 data included for context where available).

- Documents: Annual 10-K filings (and their global equivalents where applicable).

- Key Questions (Per Document):

- What were the company’s stated Strategic Priorities (from MD&A)?

- What was the company’s stated AI Focus (investments, R&D, products, partnerships)?

- What were the Key Risk Factors highlighted?

- What was the nature of their ESG Discussion?

- The AiAtHand Process (Brief Recap):

- Systematic gathering of filings.

- Advanced pre-processing to prepare large documents for LLM analysis.

- Custom prompt engineering to ask our key questions consistently for each filing.

- AI-powered extraction of summaries for each question, per document.

- Quality checks and structuring of the initial output.

- Secondary AI-assisted synthesis (like the summary table you created) to identify year-over-year trends per company.

The “Output”: Structured Insights & Summarized Trends

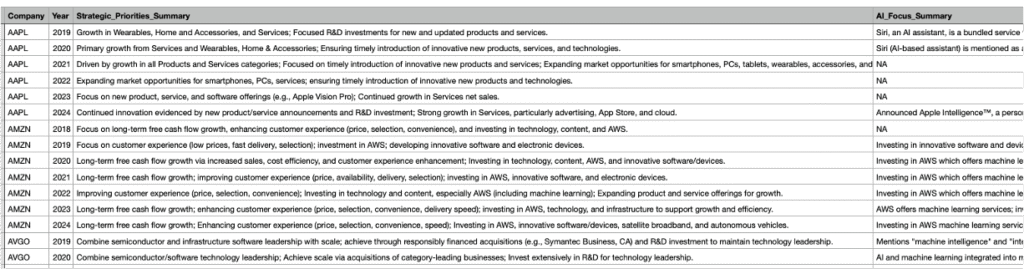

The primary output from our initial AI extraction was a detailed dataset (like the first table you showed, with per-year, per-company summaries for each question). From this, we performed a secondary analysis to synthesize long-term trends for each company.

Here’s a high-level summary of trends observed across the MAG7+AVGO from our 5-6 year SEC filing analysis:

| Company | Years Covered | Overall Summary |

| AAPL | 2019-2024 | Apple consistently prioritizes product innovation and robust Services growth. Its AI focus, initially subdued with Siri, significantly advanced in 2024 with Apple Intelligence. The company navigates persistent economic and competitive risks, now augmented by regulatory scrutiny and AI-specific challenges. ESG reporting has matured from minimal mentions to detailed human capital disclosures and acknowledgment of broader environmental and social goals and risks. |

| AMZN | 2018-2024 | Amazon consistently prioritizes long-term free cash flow and customer experience, underpinned by massive investment in AWS and technology, including a significant, recent push into AI via AWS and strategic partnerships like Anthropic. The company perpetually faces intense competition, expansion risks, and increasingly challenging government regulation. Its ESG focus evolved from no specific mention to a robust emphasis on human capital, later incorporating sustainability and climate change considerations as both initiatives and risk factors. |

| AVGO | 2019-2024 | AVGO consistently pursues technology leadership in both semiconductor and infrastructure software, primarily through significant strategic acquisitions (like Symantec, CA, and VMware) and substantial R&D. Its AI focus evolved from embedded features in software to offering dedicated AI hardware (networking, ASICs, accelerators) and platforms by 2024. The company navigates persistent risks such as customer concentration, reliance on contract manufacturing, and acquisition integration, alongside growing concerns about economic conditions and trade regulations. ESG considerations have matured from basic compliance to addressing broader stakeholder expectations and proactively managing ESG risks and initiatives. |

| GOOGL | 2018-2024 | Google consistently invests heavily in R&D for core areas (advertising, search, cloud) and expanding non-advertising revenue streams. AI/ML has been a fundamental innovation driver from the outset, becoming increasingly central to strategy, product development (e.g., Gemini), and driving massive infrastructure investment. The company navigates persistent risks from intense competition and advertising dependence, alongside significant and evolving global regulatory scrutiny (privacy, antitrust, AI). Google maintains a strong, long-standing commitment to environmental sustainability with ambitious goals, and has broadened its ESG focus over time. |

| META | 2018-2024 | Meta has consistently prioritized its advertising business (enhancing ad relevance for marketers) and its core Family of Apps, with AI and the metaverse later becoming explicit strategic pillars. Its AI focus evolved from internal optimization and ad tools to significant investment in generative AI to power content discovery, new product experiences, and open-sourcing foundational models. The company continually faces key risks related to user retention and engagement, the complex and evolving global regulatory landscape (especially concerning privacy, data, and competition), and challenges to its advertising model from reduced data signals. Its ESG discussion shifted from an initial focus on platform safety/security and supplier compliance to a robust and detailed emphasis on human capital management, including diversity, equity, and inclusion. |

| MSFT | 2019-2022, 2024 | Microsoft consistently prioritizes growth in its commercial cloud (Azure, Office 365), with AI rapidly becoming a central strategic driver, exemplified by its “AI platform wave” ambitions, Copilot offerings, deep OpenAI partnership, and massive AI infrastructure investments. The company navigates persistent risks from intense competition and cyber threats, alongside an increasingly complex legal and regulatory environment, now including AI governance. Microsoft has established significant and consistent ESG commitments, aiming for carbon negativity, water positivity, and zero waste by 2030, while also focusing on racial equity and global digital skilling, including AI literacy. |

| NVDA | 2018, 2020-2025 | NVIDIA consistently focuses on advancing its accelerated computing platform and extending its leadership in AI, computer graphics, and autonomous vehicles. Its AI strategy revolves around providing increasingly comprehensive, full-stack accelerated AI platforms (hardware, software, systems, and cloud services) for diverse AI workloads, including generative AI. The company navigates persistent risks like innovation failure, intense competition, and reliance on third-party manufacturing, with demand estimation challenges and complex export controls becoming increasingly significant. Its ESG approach evolved from minimal mentions to a strong focus on human capital, followed by clear environmental goals and broader integration of ESG principles. |

| TSLA | 2018-2024 | Tesla consistently prioritizes scaling vehicle production globally, reducing costs, developing new products (like Cybertruck and next-gen platforms), and advancing Full Self-Driving (FSD) capabilities, supported by significant and growing AI investment in FSD, robotics, and dedicated infrastructure. The company perennially navigates critical risks related to production ramp-ups, manufacturing costs, supplier dependencies, and strong competition. Its foundational mission is to accelerate the transition to sustainable energy, with its ESG disclosures evolving from this core purpose to prominently feature human capital management, responsible sourcing, and formal ESG oversight. |

Key Insights & Observations from Our AI Analysis of MAG7 +AVGO

Our comprehensive AI analysis of MAG7 and Broadcom (AVGO) SEC filings, spanning fiscals 2018/19 through 2024, unearthed several significant strategic currents and pivotal shifts. Moving beyond surface-level data, the application of LLMs to these voluminous documents allowed us to identify nuanced trends that paint a clearer picture of how these tech titans are navigating an era of rapid innovation and increasing complexity.

1. The Intensifying AI Arms Race: Diverse Strategies Emerge

A standout theme from our AI analysis of MAG7 is the undeniable acceleration of the AI arms race. While a general commitment to AI is now table stakes, distinct strategies are visible:

- Infrastructure & Platform Plays: Companies like Microsoft (with its deep OpenAI partnership and Azure AI) and Amazon (leveraging AWS for clients like Anthropic and developing its own chips) are heavily focused on providing the foundational cloud infrastructure and large model access, effectively becoming the “arsenal” for the broader AI ecosystem. Nvidia, unsurprisingly, continues its dominance in the specialized AI hardware layer, a critical enabler for all players.

- Google’s Vertical Integration Advantage: A particularly insightful finding from our AI analysis of MAG7 documents is the validation of Google’s (Alphabet’s) long-term strategy in developing custom hardware, notably their Tensor Processing Units (TPUs). This foresight into vertical integration now appears to be yielding significant cost efficiencies and performance advantages for training and deploying their large-scale AI models (like Gemini), a distinct edge in the competitive AI landscape.

- Apple’s Calculated Re-entry: What surprised us in this AI analysis of MAG7 was Apple’s AI trajectory. After the initial introduction of Siri, their explicit focus on groundbreaking, broad AI development seemed to yield to their booming Services division for several years. However, the 2024 “Apple Intelligence” announcement marks a significant, resource-intensive re-engagement, aiming to integrate generative AI deeply into their user experience, albeit with their characteristic focus on privacy and on-device processing where possible.

- Meta’s Open Source & Product Integration: Meta continues to pursue a dual strategy: significant investment in generative AI to power its discovery engine and ad tools, alongside a notable commitment to open-sourcing foundational models like Llama, potentially fostering a different kind of ecosystem engagement.

2. Evolving Risk Landscapes: Beyond Competition to Regulatory & AI-Specific Concerns

Our AI analysis of MAG7 filings reveals a clear shift in the disclosed risk factors. While traditional concerns like intense market competition and macroeconomic headwinds remain persistent:

- Heightened Regulatory Scrutiny: Discussions around the complexities of the global regulatory environment (e.g., Europe’s Digital Markets Act (DMA), antitrust investigations) have become far more prominent, particularly for giants like Google, Apple, and Meta.

- Emergence of AI-Specific Risks: More recent filings increasingly highlight risks associated with the development and deployment of AI itself – including ethical considerations, data privacy implications of AI models, potential for misuse, ensuring AI safety, and the uncertain legal frameworks surrounding AI governance.

- Supply Chain & Geopolitical Factors: Dependence on complex global supply chains (especially for hardware-focused companies like Apple, Nvidia, AVGO) and geopolitical tensions impacting trade and component sourcing are frequently cited.

3. The Maturation of ESG Disclosures: From Compliance to Strategic Imperative

The narrative around Environmental, Social, and Governance (ESG) factors within the AI analysis of MAG7 dataset shows a distinct evolution:

- Early Years: Often characterized by minimal mentions, focusing primarily on basic regulatory compliance (e.g., conflict minerals for AVGO, general environmental statements).

- Increased Emphasis on Human Capital: From around 2020-2021 onwards, there’s a significant uptick in detailed discussions around “Human Capital Management” – diversity and inclusion initiatives, employee well-being, talent development, and pay equity (prominent in Meta, Apple, Microsoft filings).

- Strategic Environmental Commitments: Companies like Google and Microsoft have long-standing environmental commitments (carbon neutrality, renewable energy), but recent filings show more ambitious and detailed goals (net-zero, water positivity, circular economy), often driven by heightened stakeholder and investor expectations, as well as climate-related risks to their operations. Tesla’s entire mission, of course, is built around sustainable energy.

- ESG as a Risk Factor: Increasingly, failing to meet ESG expectations or achieve stated goals is itself being cited as a material risk.

This detailed AI analysis of MAG7 filings demonstrates that by asking nuanced questions and systematically processing the responses, we can build a rich, longitudinal understanding of how these influential companies are navigating the future.”

Why This Matters for Your Investment Research & AI Analysis of MAG7 Strategies

This type of deep, comparative AI analysis of MAG7+AVGO SEC filings offers tremendous value:

- Validating Investment Theses: Are your assumptions about a company’s strategy or risk exposure supported by their own disclosures over time?

- Identifying Undiscovered Alpha: Spot emerging trends or shifts in focus before they are widely reported in mainstream financial news.

- Competitive Intelligence: Understand how industry leaders are positioning themselves, investing in R&D, and perceiving market risks.

- Enhanced Due Diligence: Quickly get up to speed on the strategic direction and risk profile of multiple major players.

Manually conducting such an analysis across this many companies and years is often impossible for individual researchers or small teams. This is where AiAtHand’s specialized service for automating 10-K research and custom data extraction becomes invaluable.

Get the Data: Download a Sample of Our MAG7+AVGO SEC Filing Analysis Output

To give you a tangible feel for the kind of structured data AiAtHand can deliver, we’re offering a sample excerpt of our AI analysis of MAG7+AVGO SEC filings output. This Excel file contains the per-document extracted summaries for a selection of the questions and years.

Conclusion: AiAtHand – Your Partner for Deep, Scalable Financial Document Analysis

This MAG7+AVGO SEC filing analysis is just one example of how AiAtHand can transform overwhelming volumes of financial documents into clear, structured, and actionable intelligence. Our AI-powered platform, combined with expert prompt engineering and quality oversight, allows us to tackle your most complex data extraction challenges, delivering custom datasets tailored to your unique research questions and investment strategies.

Whether you’re analyzing tech giants, specific industries, or a custom list of companies, AiAtHand provides the speed, scale, and precision you need.

Ready to unlock deeper insights from financial filings?

Contact AiAtHand today to discuss your project and get a custom quote. Let’s automate your data extraction and empower your analysis.